Hsmb Advisory Llc Fundamentals Explained

Hsmb Advisory Llc Fundamentals Explained

Blog Article

Hsmb Advisory Llc for Beginners

Table of ContentsThe Definitive Guide to Hsmb Advisory LlcHsmb Advisory Llc for DummiesExcitement About Hsmb Advisory LlcGetting My Hsmb Advisory Llc To WorkHsmb Advisory Llc for DummiesThe Single Strategy To Use For Hsmb Advisory Llc

Ford claims to steer clear of "cash worth or long-term" life insurance policy, which is even more of an investment than an insurance coverage. "Those are very complicated, come with high commissions, and 9 out of 10 people do not require them. They're oversold due to the fact that insurance coverage representatives make the largest compensations on these," he says.

Special needs insurance coverage can be costly, nevertheless. And for those that select long-term care insurance policy, this plan may make special needs insurance policy unnecessary. Read extra concerning lasting care insurance policy and whether it's appropriate for you in the next area. Long-term treatment insurance policy can aid pay for expenses related to lasting care as we age.

Hsmb Advisory Llc for Beginners

If you have a persistent health problem, this kind of insurance can wind up being critical (Life Insurance St Petersburg, FL). Nevertheless, don't allow it stress you or your savings account early in lifeit's generally best to secure a plan in your 50s or 60s with the anticipation that you won't be using it until your 70s or later on.

If you're a small-business owner, consider safeguarding your source of income by buying service insurance coverage. In the occasion of a disaster-related closure or period of rebuilding, company insurance coverage can cover your earnings loss. Take into consideration if a significant weather condition occasion influenced your store or manufacturing facilityhow would that affect your earnings? And for the length of time? According to a report by FEMA, between 4060% of small companies never ever resume their doors complying with a catastrophe.

Plus, making use of insurance might occasionally cost greater than it saves over time. For instance, if you get a chip in your windshield, you might take into consideration covering the repair service expense with your emergency situation financial savings rather of your auto insurance coverage. Why? Since using your vehicle insurance policy can create your monthly costs to go up.

Rumored Buzz on Hsmb Advisory Llc

Share these suggestions to shield loved ones from being both underinsured and overinsuredand seek advice from with a relied on expert when required. (https://www.storeboard.com/hsmbadvisoryllc)

Insurance that is acquired by a private for single-person coverage or protection of a family members. The private pays the premium, in contrast to employer-based health and wellness insurance coverage where the employer frequently pays a share of the costs. Individuals might buy and purchase insurance from any kind of strategies readily available in the individual's geographic area.

Individuals and families may qualify for financial assistance to lower the cost of insurance policy costs and out-of-pocket prices, yet only when enlisting via Attach for Wellness Colorado. If you experience particular modifications in your life,, you are eligible for a 60-day duration of time where you can sign up in an individual plan, even if it is outside of the annual open registration duration of Nov.

15.

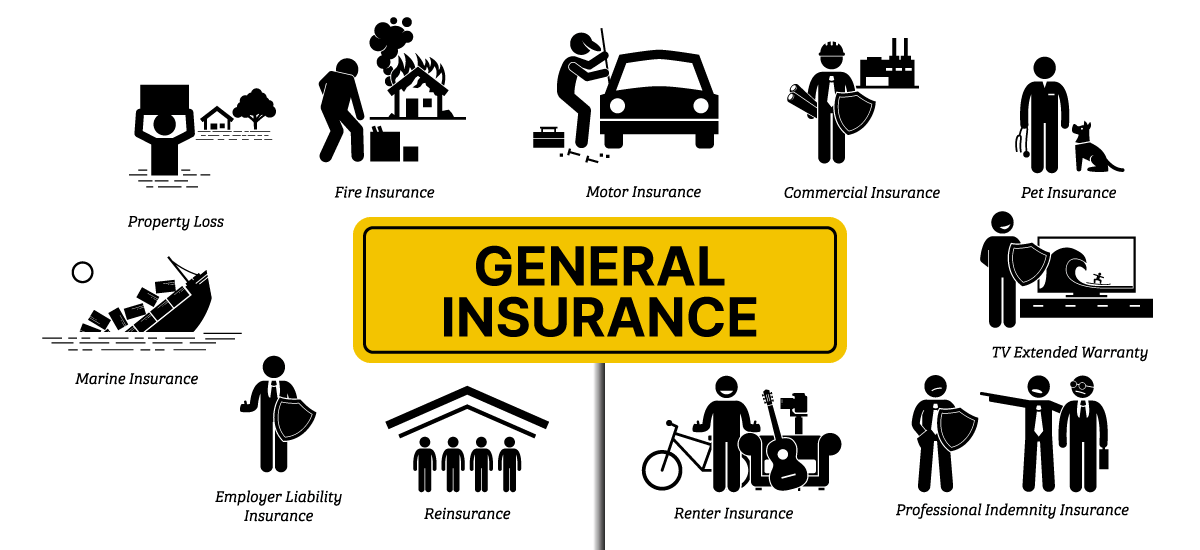

It might appear straightforward yet understanding insurance types can also be confusing. Much of this confusion originates from the insurance policy sector's recurring goal to design individualized protection for insurance holders. In developing adaptable plans, there are a variety to choose fromand every one of those insurance policy types can make it challenging to understand what a specific plan is and does.

The 6-Second Trick For Hsmb Advisory Llc

The most effective location to begin is to discuss the distinction in between both kinds of basic life insurance policy: term life insurance policy and permanent life insurance policy. Term life insurance coverage is life insurance policy that is only energetic for a while duration. If you pass away during this duration, the individual or people you've called as recipients may obtain the cash money payout of the policy.

However, lots of term life insurance policies allow you transform them to an entire life insurance policy, so you don't shed coverage. Generally, term life insurance policy plan costs payments (what you pay per month or year into your plan) are not locked in at the time of acquisition, so every five or 10 years you possess the plan, your premiums can rise.

They also tend to be more affordable total than entire life, unless you acquire an entire life insurance policy policy when you're young. There are likewise a couple of variations on term life insurance coverage. One, called group term life insurance policy, prevails amongst insurance policy alternatives you could have accessibility to via your company.

Not known Facts About Hsmb Advisory Llc

An additional variation that you may have accessibility to with your company is additional life insurance policy., or burial insuranceadditional insurance coverage that could assist your family members in case something unanticipated happens to you.

Permanent life insurance coverage just refers to any kind of life insurance coverage plan that doesn't end.

Report this page